FOORD INTERNATIONAL TRUST 20-YEAR ANNIVERSARY

Foord’s flagship global fund, the Foord International Trust (FIT), was launched 20 years ago this March. Multiple-counsellor portfolio manager BRIAN ARCESE examines the fund’s performance through the lens of the investment cycle.

Although motivated by South Africa’s 1997 introduction of asset swaps, Foord’s experience of managing multi-asset, absolute return portfolios in South Africa was FIT’s true foundation. The fund’s conservative, flexible investment policy was a natural extension of Foord’s investment philosophy and proven South African investment capability.

FIT’s objective is to achieve long-term, inflation-beating US dollar returns over rolling five-year periods with minimum investment risk. The fund has delivered by achieving 6.6% per annum after fees in US dollars, surpassing the 2.1% annualised growth in US inflation and exceeding global developed market equities (+5.6%) and its peer group (+4.1%).

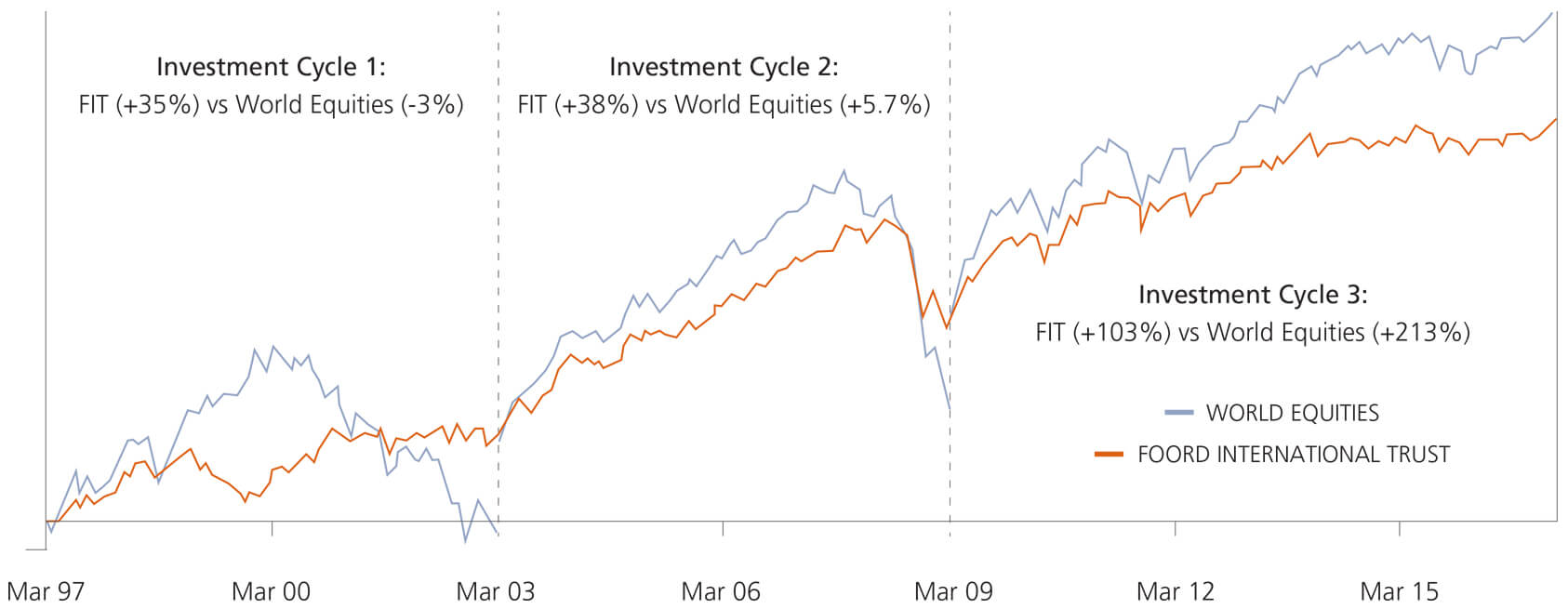

Over the past 20 years, investors have experienced two investment cycles and we are partway through a third (an investment cycle tracks a business cycle, which is roughly six years long and is measured from one economic peak to the next or one trough to the next – see Foreword 34, 2nd Quarter 2015). In this article, we analyse the fund’s performance in each cycle to illustrate its credentials.

INVESTMENT CYCLE 1: (FIT Inception – March 2003)

THE DOTCOM BUBBLE

Staying true to mandate and positioned conservatively in high-quality companies and government bonds, FIT soon lagged global equity markets prior to the dotcom bubble peak, returning just 19% cumulatively versus 83% for developed market equities. Thereafter, FIT’s conservative security selection and asset allocation aided returns. From bubble peak to market trough, developed market equities declined 41% while FIT posted a positive 11% cumulative return. Over this investment cycle, FIT generated cumulative returns of 35% (+4.9% annualised) versus a developed market equity return of -3% (-0.5% annualised).

INVESTMENT CYCLE 2: (March 2003 to March 2009)

EXPANSION TO GLOBAL FINANCIAL CRISIS (GFC)

During this period of steady economic expansion, FIT again lagged developed market equities, achieving a cumulative 95% return versus 146% for global equity bourses until the crash. Underperformance was expected considering the fund’s conservative 62% average weight to listed equities, but the outcome was surprisingly credible. As the global financial crisis unfolded, the fund’s conservative positioning benefitted investors, with the fund declining 29% from peak to trough, compared to the 57% global equities drawdown. Across the investment cycle, FIT generated cumulative returns of 38% (+5.5% annualised) versus a developed market equity return of 5.7% (+0.9% annualised).

INVESTMENT CYCLE 3: (March 2009 to present)

POST-GFC RECOVERY AND EXPANSION

After the GFC, global economic growth has been slow and inconsistent, but gradually improving. However, artificially-low interest rates fuelled equity and bond market returns. In this environment, with a less-than-full weight in listed equities, FIT again lagged equity markets with a cumulative return of 103% compared to global equity returns of 213%.

The current investment cycle at eight years and counting is longer than normal, but is still incomplete. Investors might well ask whether it will end differently to the previous two cycles and what could they expect from FIT’s relative performance. The largest dissimilarity between the current cycle and the previous two is the notable lack of opportunities to generate real returns outside of select equity markets. While in previous cycles, as market valuations neared their peak, investors could adjust portfolios towards bonds and cash, each asset class offering a real yield, this is not the case today. Accordingly, the managers have maintained a larger equity allocation compared to previous cycles.

That said, structural tailwinds in certain markets afford unique investment opportunities. For example, the fund’s Chinese investments, a market which has become increasingly developed and accessible to foreign investors, continue to profit from the structural growth of that country’s middle class. In addition, the fund’s healthcare sector investments are poised to benefit from the aging global population and the expected increased healthcare services and pharmaceuticals consumption.

As we look ahead, the global investment case remains robust. The recovery, muted for some time, appears to be accelerating. US personal wages are increasing, spurring growth in the world’s largest, consumer-driven economy, while European firms recently reported their first quarter of positive annual growth in nearly two years. Despite improving economic fundamentals, much investment uncertainty remains. The unwinding of overly-accommodative monetary policy in the developed economies, coupled with slowing investment growth in China, should cause increased volatility.

With growth prospects uncertain and developed market equity valuations stretched, FIT remains cautiously positioned. Shares in the portfolio are concentrated in companies that generate higher returns than global peers while operating with less leverage – these firms should grow their earnings ahead of developed market inflation. The fund’s cash position, although a drag in rising equity markets, provides optionality to exploit expected market volatility and stability should the cycle abruptly end and markets draw down.

As we near the end of this third investment cycle, it is our expectation that FIT will again provide investors with the same degree of protection afforded during the first two full investment cycles of its existence. When this third investment cycle is complete, we expect the fund's relative returns to more closely mirror historical patterns.

Insights

10 Feb 2026

Wei Lu Tan appointed CEO of Foord Singapore

We are pleased to announce the appointment of Wei Lu Tan as Chief Executive Officer of Foord Singapore with effect from 1 January 2026. Her nomination was approved by the Monetary Authority of Singapore in December…

05 Feb 2026

MARKETS IN A NUTSHELL — FOR JANUARY 2026

January started with a geopolitical bang, and the world’s risk premium rose - forcing markets to price a world in which alliances appear more transactional and institutions more exposed to politics. In this month’s…