Weathering the Covid-19 Market Rout

Developed market equities fell precipitously last month on expectations the covid-19 pandemic would trigger a global recession. The S&P 500 recorded its fastest-ever bear market correction (-20% in 20 days). Industrial commodities and oil were casualties as the Russia-Saudi Arabian oil price war added to the panic.

We did not forecast nor expect a global pandemic. But we were cognisant of the expansion’s late stage and the elevated global risk environment. Our base case expectation was for increased volatility with some prospects for a correction in the medium term. The catalyst that sparks such events is usually something that very few people see coming.

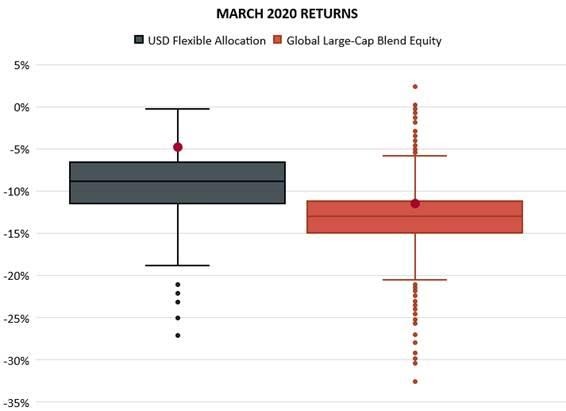

The market declines have been painful for investors. But Foord’s portfolios have protected capital better than most in their respective categories through the market crisis. The chart below shows the Morningstar category March 2020 return dispersions for each fund. Foord global funds are denoted by the large red dots – despite negative returns, both are first quartile over the month and comfortably ahead of market index benchmarks.

It is self-evident that investment markets are forward looking. But investors’ reaction to the global contagion was mostly coincidental. Perhaps because of a grave misunderstanding that regional efforts would restrict the virus to Asia (like SARS in 2003). Or because the human mind struggles to understand and value large unknowns

Whatever the cause, the lag in the market’s response gave Foord’s global fund managers time. In January, we increased portfolio hedging in the flagship Foord International Fund. The fund’s positioning was already conservative. We hedged more in February. For those with technical knowledge, we bought put options on the S&P 500 index and sold S&P futures.

The Foord Global Equity Fund had less exposure to the expensive US markets than peers and global stock indices. It has fared better than most global equity funds as a result.

Importantly, this outcome follows on a period of relatively strong performance through a much stronger market environment in 2019 and therefore has not been achieved via binary (and risky) market timing bets. Rather this asymmetric payoff profile has been achieved through the intelligent application of option strategies, proper diversification and careful avoidance of underlying assets which we thought might be particularly vulnerable in a market sell-off.

Today, the covid-19 infection exceeds one million confirmed cases in 195 countries and territories. Over 70,000 people have perished. Governments have quarantined one fifth of the world’s population. All these statistics will inevitably worsen in the coming weeks.

Quarantines and travel prohibitions will slash global economic output in the first half of 2020. There will be recessions. These will cause millions of job losses, especially in service industries. Governments and central banks have responded with massive liquidity and fiscal packages. But there will be many corporate failures and personal bankruptcies.

Some countries dealt with the pandemic faster and more efficiently than others. They have seemingly arrested the infection rates. But they are now finding it difficult to properly open their economies without re-importing the virus from countries behind them on the infection rate control curve. Such are the realities of a highly interconnected global economy.

It seems clear to us that a three to six week lockdown is probably not long enough to get on top of the virus. But we also think that a three to six-month lockdown is more than most economies (and societies) can withstand. History will judge whether the virus itself or mankind’s response was most damaging to society.

There are still very high levels of uncertainty in the forecast horizon. As such, we will continue to exercise caution. The strategy is focused on quality companies well placed to survive the near-term economic headwinds and thrive once economic activity resumes towards more normal levels in time. We are also maintaining a high degree of diversification and liquidity. We have added to some quality companies that we already own on price weakness. We have added some new quality names to the portfolios. This activity is however still at the margin.

Stay invested. Your investments are in safe hands. Opportunities now opening up for long-term investors will not be squandered. The Foord global funds are exceptionally well positioned for the unfolding environment.

Insights

10 Feb 2026

Wei Lu Tan appointed CEO of Foord Singapore

We are pleased to announce the appointment of Wei Lu Tan as Chief Executive Officer of Foord Singapore with effect from 1 January 2026. Her nomination was approved by the Monetary Authority of Singapore in December…

05 Feb 2026

MARKETS IN A NUTSHELL — FOR JANUARY 2026

January started with a geopolitical bang, and the world’s risk premium rose - forcing markets to price a world in which alliances appear more transactional and institutions more exposed to politics. In this month’s…