Navigating Global Markets With Shariah-Compliant Equities

Shariah-compliant investing has long formed a cornerstone of Islamic finance, providing Muslim investors with opportunities to participate in global financial markets while adhering to the principles of their faith. For much of its modern history, Shariah investing has been concentrated in asset classes such as Sukuk—Islamic bonds structured to avoid interest payments—and tangible assets like property, which offer predictable income streams and tangible asset backing in line with Islamic jurisprudence. These investments have offered a sense of security and alignment with ethical guidelines rooted in Islamic law, or Shariah.

However, as the global Islamic finance industry has matured, so too has the range of investment options available to Shariah-conscious investors. While Sukuk and real estate will continue to form an important part of faith-based portfolios, there is an increasing recognition that carefully selected Shariah-compliant equities can provide an additional and highly effective means of long-term capital growth. The evolution of this asset class reflects broader changes in investor objectives, particularly among the younger generation of Muslim investors, who are seeking to diversify their portfolios beyond traditional income-focused instruments and to participate in the broader opportunities offered by global capital markets.

THE GLOBAL ISLAMIC FINANCE INDUSTRY

The global Islamic finance industry has expanded rapidly in recent years, with total assets under management surpassing USD 3.25 trillion in 2022 and projected to exceed USD 5 trillion by 2025, according to the Islamic Financial Services Board. While the largest share of these assets continues to be held in Islamic banking products and Sukuk, Shariah-compliant equity investing has emerged as an increasingly important segment within the industry.

As of 2024, assets under management in Shariah-compliant equities have grown to over USD 123 billion, representing a 70% increase over the past five years. This growth has been driven by both institutional investors — particularly from the Middle East and Southeast Asia — and private wealth investors across Europe and North America. Greater access to global equity markets, coupled with improved governance frameworks and the introduction of widely recognized screening methodologies, has supported the continued expansion of Shariah-compliant equity investing.

The global universe of Shariah-compliant equities has expanded significantly since the launch of the Dow Jones Islamic Market Index in 1999. Today, the Dow Jones Islamic Market World Index comprises more than 1,400 constituents from 56 countries, offering exposure to a broad range of industries and regions.

WHY SHARIAH-COMPLIANT EQUITIES?

Equity investing, when conducted within the parameters of Shariah principles, provides several distinct advantages for investors. First, equities offer the potential for capital appreciation over the long term, providing an important counterbalance to the lower yields typically offered by Sukuk. Second, the inclusion of equities diversifies portfolios across asset classes, sectors, and geographies, reducing the concentration risks associated with traditional real estate or fixed-income holdings.

Third, Shariah-compliant equities align closely with the principles of ethical and socially responsible investing. Shariah screens naturally exclude companies engaged in activities deemed harmful or unethical—such as alcohol production, gambling, and weapons manufacturing—while also limiting exposure to highly leveraged businesses and those reliant on interest-based income.

Shariah equity strategies also often exhibit a quality bias, favouring companies with low levels of debt, sustainable cash flows, and prudent governance. This focus has historically resulted in enhanced downside protection during periods of market volatility.

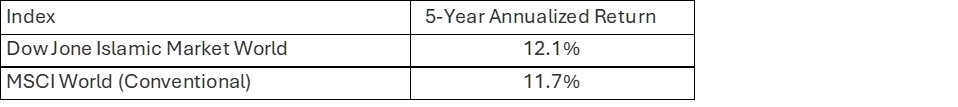

The performance of Shariah-compliant equity indices over the long term has been competitive, and in some cases superior, to conventional benchmarks. According to S&P Dow Jones Indices, the Dow Jones Islamic Market World Index achieved annualised returns of 12.1% over the five years ending in 2024, compared with 11.7% for the MSCI World Index over the same period.

This outperformance can be attributed to several factors, including the exclusion of highly leveraged companies, a bias toward high-growth sectors, and the emphasis on quality businesses with sustainable earnings and strong governance practices. Shariah-compliant portfolios have also demonstrated resilience during periods of market stress, benefiting from lower exposure to debt-fueled sectors and a focus on companies with robust financial health.

PRINCIPLES AND PROCESS OF SHARIAH EQUITY INVESTING

The process of investing in Shariah-compliant equities involves a rigorous and continuous screening process designed to ensure that companies meet both ethical and financial criteria set out by Shariah law. This process is typically divided into two primary stages: business activity screening and financial ratio filtering.

The first stage excludes companies involved in industries or activities prohibited under Islamic principles. These include conventional financial services, alcohol and tobacco products, pork-related goods, gambling, pornography, and weapons manufacturing. Generally, a company must generate less than 5% of its total revenue from these prohibited activities to remain eligible for inclusion in a Shariah-compliant portfolio.

The second stage applies financial ratio screens to ensure companies maintain prudent financial practices consistent with Shariah law. Companies must have a debt-to-market-capitalisation ratio of less than 33%, ensuring that they are not overly reliant on interest-based financing. Furthermore, cash and interest-bearing securities, as well as accounts receivable, must represent less than 33% of total assets. These restrictions promote a focus on companies with sound balance sheets and limited exposure to conventional financial instruments.

Once these screens have been applied, ongoing compliance is monitored by Shariah boards or independent scholars. Any non-permissible income derived from incidental activities, such as interest earned on cash balances, is purified through charitable donations, maintaining the ethical integrity of the investment.

FOORD’S APPROACH INVESTING: LONG-TERM, QUALITY-FOCUSED

For over 40 years, Foord has remained dedicated to protecting and growing investor capital through a disciplined, long-term approach. Central to this philosophy is the belief that risk is the permanent loss of capital, not short-term market movements. Foord focuses on investing in high-quality businesses with strong balance sheets, exceptional management, sustainable cash flows, and competitive advantages that support long-term value creation. By combining rigorous, forward-looking research with a strict valuation discipline, Foord seeks to deliver returns while safeguarding capital.

Foord’s Shariah-compliant strategies are a natural extension of its core investment philosophy. The emphasis on capital preservation, financial sustainability, and ethical investing aligns closely with Shariah principles.

Foord’s portfolio is constructed through a bottom-up stock selection framework combined with rigorous screening process, excluding companies involved in prohibited activities, while adhering to strict financial ratio guidelines.

The investment philosophy is rooted in recognizing the deeper realities of businesses (and their operators), sectors and markets, and what they can be worth over time. When the assessment of this worth is highly differentiated from market expectations, we are unafraid to take highly concentrated, contrarian positions that are very different to traditional market benchmarks.

The study of a business’ worth (vs its market price) is rooted in our extensive experience covering all global sectors over the past two decades. We spend a disproportionate amount of time studying the fundamental moats of the businesses and management culture and believe that stock prices follow future earnings. Our independent analysis often allows us to have strong variant perceptions around earnings and valuation, particularly over the long-term.

We have been in this business long enough to recognize important patterns and structural changes across markets, industries and businesses, which allow us to invest with conviction even when our analysis is meaningfully different to market expectations. This has been particularly helpful in identifying inflection points with a contrarian mindset, which is a cornerstone of our alpha generation.

The market often focuses on factors that matter in the short-run and value businesses accordingly. This creates meaningful opportunities for investors that understand deeper long-term truths about businesses not evident to superficial observers.

Furthermore, Foord recognizes that value and growth are two sides of the same coin. The market likes to label investors by style. To us, value is a broad religion. We find value in seemingly expensive fast-growing compounders or in deep value situations where we can buy a dollar for fifty cents, and everything in-between.

Our portfolio construction is diversified not by a greater number of stocks, but through uncorrelated economic factors. The world is constantly changing and inherently unpredictable. We don’t profess the ability to predict the future and never make zero-one bets. Our efforts are focused on what we know well, and we diversify our risk of being wrong through uncorrelated economic factors where our investors should fare well regardless of how the world evolves over time. We prefer to diversify in the most concentrated manner possible, allowing us to know what we own extremely well.

We construct portfolios that are built not just to thrive, but survive, whatever the backdrop. Investing behind best-in-class (owner-operator) management teams that excel at capital allocation and building exceptional corporate cultures is another way we mitigate risk and identify consistent market share gainers.

The Foord team is on a never-ending quest of finding value and managing risk in the highest quality manner possible. This means constantly challenging ourselves to be the best we can be in every manner possible.

By combining Foord’s quality-focused approach with Shariah compliance, investors benefit from an ethical, disciplined strategy designed to deliver long-term, sustainable returns in line with their values.

Insights

10 Feb 2026

Wei Lu Tan appointed CEO of Foord Singapore

We are pleased to announce the appointment of Wei Lu Tan as Chief Executive Officer of Foord Singapore with effect from 1 January 2026. Her nomination was approved by the Monetary Authority of Singapore in December…

05 Feb 2026

MARKETS IN A NUTSHELL — FOR JANUARY 2026

January started with a geopolitical bang, and the world’s risk premium rose - forcing markets to price a world in which alliances appear more transactional and institutions more exposed to politics. In this month’s…