Opportunities from uncertainty: Beyond the short-term pain of the current regulatory wave in China

“When written in Chinese, the word ‘crisis’ is composed of two characters. One represents danger and the other represents opportunity.”

John F. Kennedy, 1959

LEVELLING THE PLAYING FIELD

The Chinese authorities have tightened the regulatory environment significantly over the last two years, rolling out new measures to improve governance oversight across high-profile industries. Prominent examples are the new antitrust rules for tech companies which resulted in fines for dominant players like Alibaba and rules to turn the ‘for-profit’ tutoring industry into non-profit. It remains ironic that regulations which were intended, in part, to create order and certainty, roiled global markets as investors debated the “uninvestability” of the Chinese market and priced in significant fears.

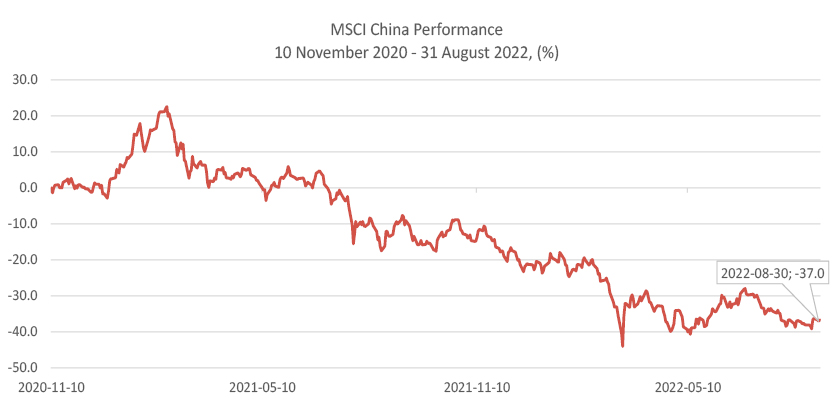

Chart 1: Chinese equities fell and remained depressed since 10 November 2020.

Chart 1 source: Bloomberg, MSCI, USD, as at 31 August 2021. e10 November 2020 marked the day the State Administration for Market Regulation (SAMR) released its draft antitrust guidelines.

We at Foord took a deep breath then a step back to dissect what the Chinese leaders were actually communicating through these regulations. After much internal debate, we agreed that the Chinese leadership wanted to correct market failures that have unintended social consequences, detrimental to the nation’s long-term development. As a command economy, the authorities could act quickly to improve areas of previously weak or immature regulation.

SEEKING “RENT-SEEKERS”

The antitrust regulations targeting tech platforms, for example, were to eradicate monopolistic behaviours such as exclusivity contracts and predatory pricing. These anti-monopoly rules are aimed at reducing the rent-seeking ways of the dominant tech platforms. The purpose was not to shut them down, but to regulate them. The authorities seek to promote fair competition to allow the next generation of innovators to emerge and not to be gated by the monopolistic crowding-out displayed by existing market leaders.

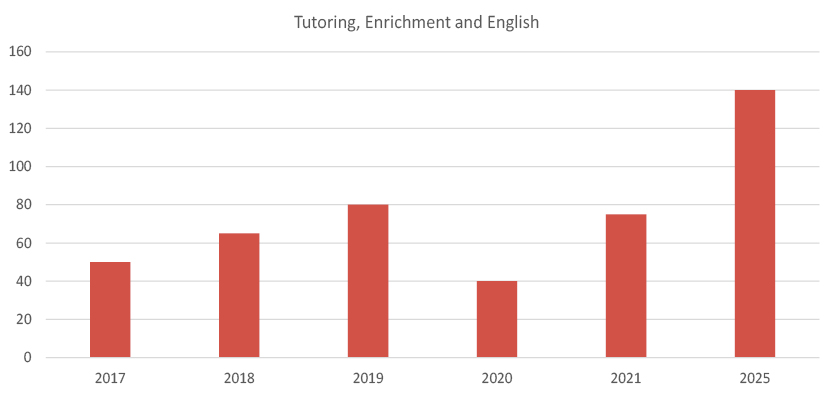

Similarly, regulations banning companies that teach school curriculum from making profits, raising capital or going public have noteworthy social goals. Aside from extreme pressures on students, the financial burden on parents was rising rapidly as the tutoring industry soared. The increased costs of having a child were starting to impact birth rates and adding to China’s demographic headwinds. The government needed to tackle this issue resolutely to ensure China’s long-term competitiveness.

Chart 2: Growth estimates before the government crackdown

Market size of China’s K-12 after school training businesses 2017-2025E (RMB 10 Billion)

Chart 2 source: China K-12 After-school Training ‘To Business’ Market White Paper 2020, National Institute of Education Sciences, TAL Group, Oliver Wyman. 2020 to 2025 are estimates.

These policy changes have increased investment uncertainty in the short-term. However, we believe the long-term results of these regulations should drive healthier economic development, helping China towards its goal of common prosperity. The government wants to build a stronger middle-class, to advance innovation and get stronger as a nation.

The objective was not to reject a market driven economy. In fact, the government continues to view vibrant private enterprise to be the most effective way to drive innovation, wealth creation and thus fulfilling its common prosperity goals. However, as is often the case, growth and innovation in select industries outpaced that of regulation. A meaningful change in rules and regulations was required to create domestic opportunity and to weed out bad actors from the marketplace.

THE RISING CORE

Aligned to the Chinese government’s goal of common prosperity and a ‘stronger middle’, Foord has held a positive view on the rising Chinese middle class and the corresponding consumption growth.

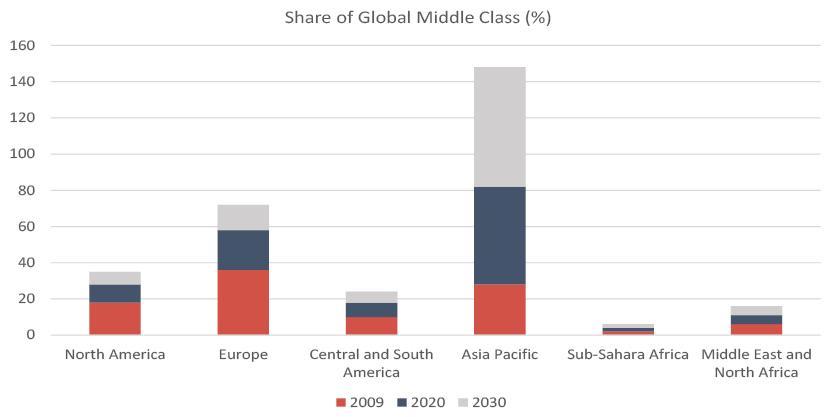

As evidenced in the chart below, the world’s middle-class is rapidly shifting East– in 2009, 54% of the global middle-class was in Europe and North America and in 2030 it is projected that 66% of the world’s middle class will hail from Asia. It is important to highlight that the middle-class population in Europe and North America is not declining, rather the percentage shifting to Asia is entirely a function of growth within Asia benefiting from a positive loop of a younger population, higher productivity, urbanization, job creation and consumption.

Chart 3: Asia Middle Class is dwarfing other regions.

Chart 3 source: OECD Development Centre: The Emerging Middle Class in Developing Countries by Homi Kharas, January 2010. Working Paper No. 285.

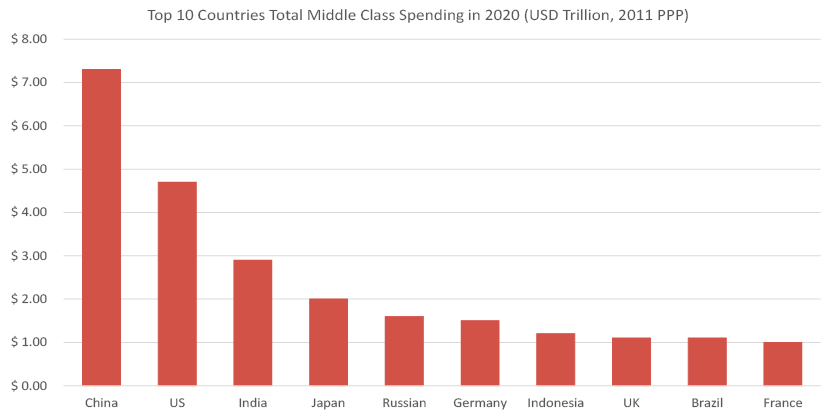

Chart 4: China’s middle class is driving consumption spending

Chart 4 source: Homi Kharas and Meagan Dooley, China’s Influence on the global middle class, October 2020. PPP refer to purchasing power parity.

OUR CHINA PLAYBOOK

Akin to investing in any region, country, or security, investing in China is not without risk – in fact, we do not consider ourselves China bulls or China bears. Rather, we have never felt constrained by conventional benchmarks and have always aimed to construct portfolios that are diversified across economic factors. We seek to deploy capital into investments when the macro or structural tailwinds meet bottom-up attractive fundamental valuations – today many securities in China meet these criteria.

Dovetailing a multi-generational shift in Chinese society and culture, we identified some of the many sub-themes that could reap benefits from the changes today and the innovations for tomorrow.

#1 E-Commerce

China continues to be a giant for e-commerce both domestically and in the world. We look for companies that benefit from increased domestic consumption, globalization and international trade. Electronics and Fashion items continue to comprise about 50% in each year.

Chart 5: Rising domestic and international e-commerce activity = rising revenue

Chart 5 source: ecommercedb, Statista. June 2022. 2022 to 2025 are estimates.

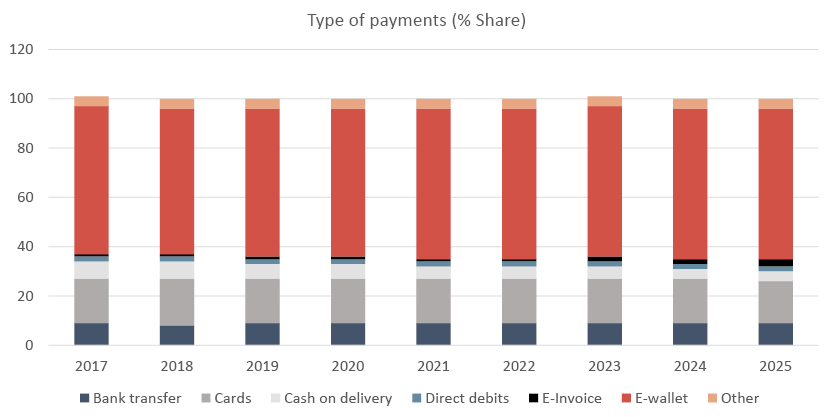

#2 Mobile Payments

Continuing on the consumption theme, the method of payments see electronic methods continuing to dominate for the foreseeable future. The ease of settlement and ability to pay on-the-go are a result of financial technology innovation. We look for companies who will benefit from this directly or some derivative line of business.

Chart 6: Cashless payments dominate

Chart 6 source: ecommercedb, Statista. June 2022. 2022 to 2025 are estimates.

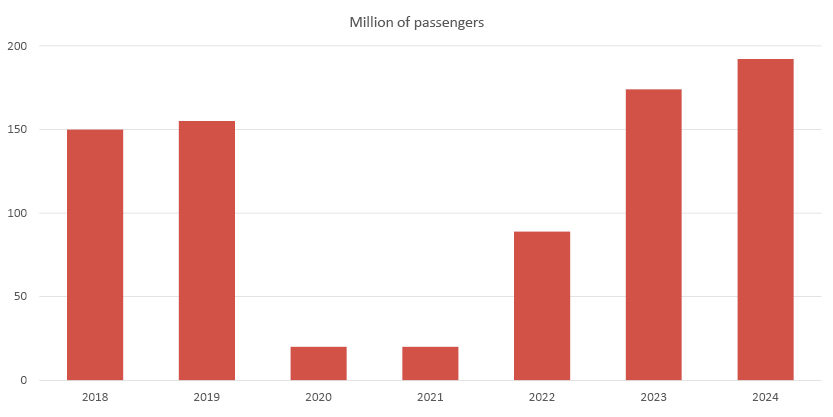

#3 Travel and Entertainment

Domestic optimism is tempered with China’s ongoing battle with balancing COVID-19 policies and economic growth. However, we look beyond the quagmire and see a country hungry for travel with a growing “vacation war chest”. In January 2022, a new five-year development plan was issued by the Civil Aviation Administration of China (CAAC), which called the 2023-2025 timeframe “a period of growth”. In its five-year plan, the regulator expects to have 270 civil airports by end-2025, compared to 241 at the end of 2020. We look for areas which will benefit from a J-curve of both domestic and international travel when the country finds an equilibrium between policy and pragmatism.

Chart 7: Recovery of outbound travel

Chart 7 source: When And Where Will We See Chinese Travelers Again, Chinese traveler recovery dashboard (26 April 2022). Oliver Wyman

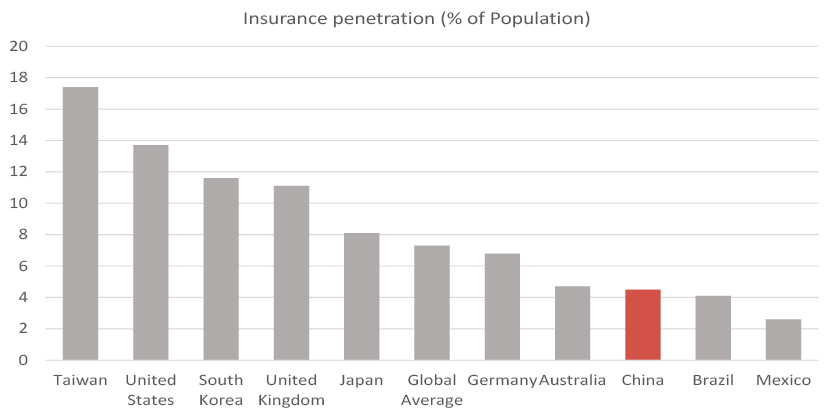

#4 Financial Security

In addition to spending, a growing middle class also places focus on finances, particularly the need to insure oneself and family. In terms of coverage, China is disproportionately under insured with a personal insurance penetration rate of 4.5% vs a global average of 7.3%. There is an immense opportunity which we hope to capitalize on by identifying direct and indirect beneficiaries of this inevitable wave.

Chart 8: China is under-insured

Chart 8 source: Statista, Life and non-life insurance penetration in selected countries and territories worldwide in 2020, July 2021.

THE BOTTOM LINE

We remain optimistic of China’s long-term growth trajectory. This round of regulation serves as a healthy reminder to tech platforms and across industries to compete on value creation instead of monopolistic behaviour. It provides a more conducive environment for new business innovations to flourish and we are excited to discover what comes next. Regardless, we continue to expect more headlines, sensational and not…but we do not fear it. Rather, at Foord we choose to embrace the dissonance that change creates in the markets and the opportunities that come with it.

Insights

10 Feb 2026

Wei Lu Tan appointed CEO of Foord Singapore

We are pleased to announce the appointment of Wei Lu Tan as Chief Executive Officer of Foord Singapore with effect from 1 January 2026. Her nomination was approved by the Monetary Authority of Singapore in December…

05 Feb 2026

MARKETS IN A NUTSHELL — FOR JANUARY 2026

January started with a geopolitical bang, and the world’s risk premium rose - forcing markets to price a world in which alliances appear more transactional and institutions more exposed to politics. In this month’s…